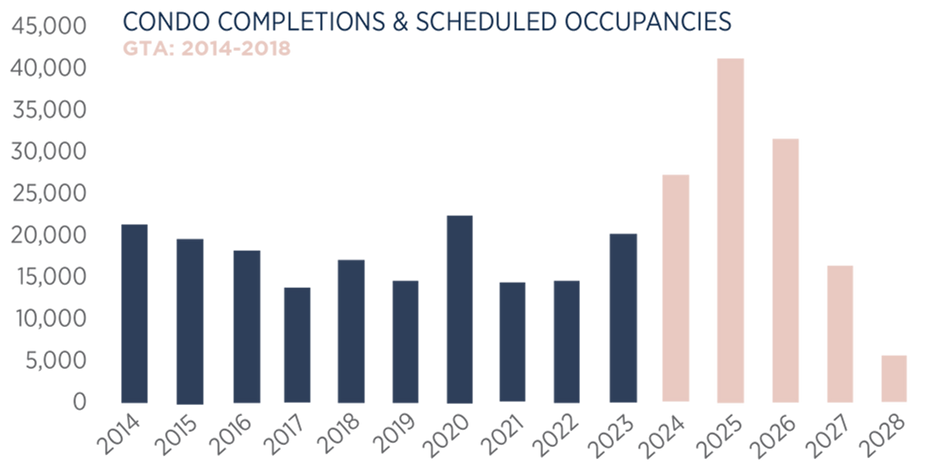

Sales of new and as-yet unbuilt condominiums have fallen to decades-long lows in recent months, but a looming and more urgent issue is what to do about thousands of complete or nearly complete unsold apartments and townhouses.

“You’ve got almost 96,000 units under construction, due to complete and deliver over the next three years,” in the Toronto-region according Fraser Wilson, a former senior vice-president with pre-construction sales experts International Home Marketing Group. It was industry standard that perhaps 20 per cent of those units went unsold when those projects launched between 2018-2022. Now though, his contacts in the industry are finding that the amount of unsold product is increasing as more and more buyers walk away from their purchase contracts.

“The developers are now entering a phase where consumers are saying ‘I’m not going to be able to close on this unit. Sorry, keep my deposit, seek legal action.’ We’re just on the forefront of that taking place,” he said.

It’s a phenomenon lawyer Mark Morris recognizes as he sees increasing numbers of clients coming to his Legalclosing.ca business looking for some kind of Hail Mary pass to keep them from defaulting on contracts that carry stiff financial penalties. In his view, the market is in the middle of the “pain cycle” of a real estate correction when first the buyers, then the builders and finally the lenders lose money.

“Lender pain is really not all that acute, and they’ve made provisions for losses,” said Mr. Morris. “Builder pain is becoming quite acute, they are looking at greater defaults. They are trying to pre-empt it by getting further financing proofs [including mortgage pre-approvals earlier than normal]. They are getting very worried about it.”

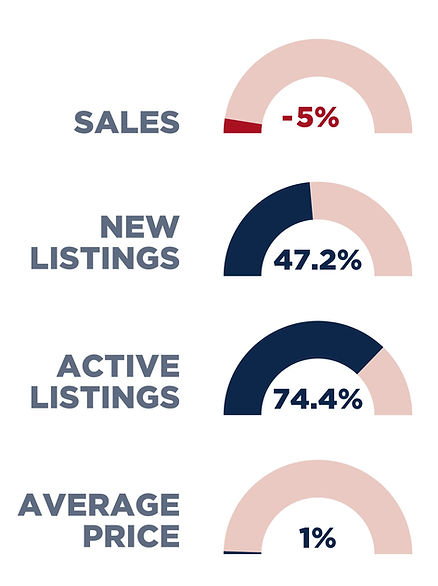

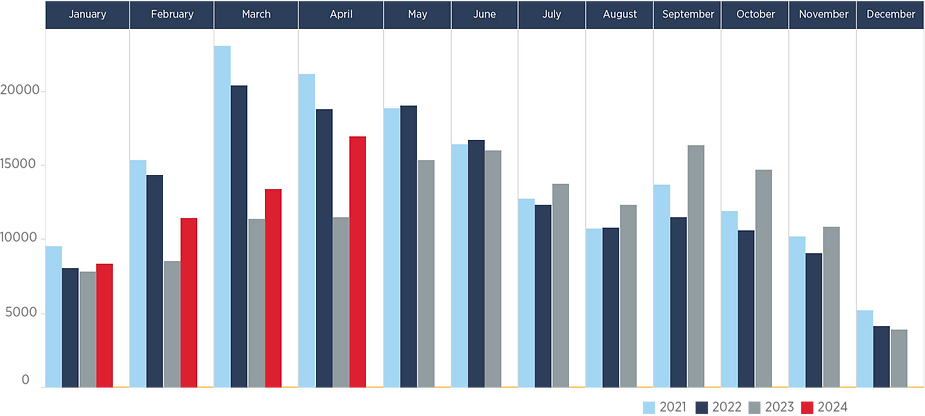

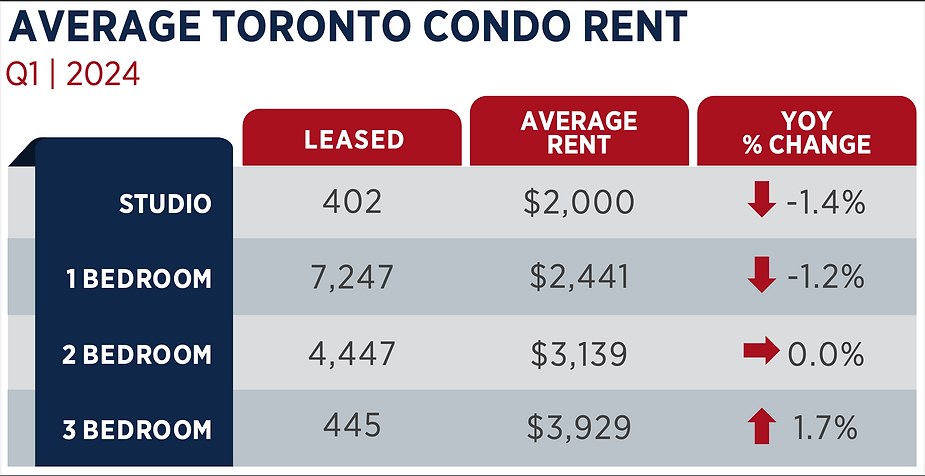

Real estate analysts note that consumer pain began as soon as interest rates began to rise, making existing mortgages more expensive and killing both the assignment market – a sort of condo futures marketplace where pre-construction buyers used to try to swap contracts that had seen some potential equity gains over time – and slowing the resale market down to where condo prices began to drop.

“Two years into the slowdown, it’s biting because builders are delivering,” said Pauline Lierman, vice-president market research with Zonda Urban. “People have talked about this for so long and now it’s happening.”

Builders are taking a varied approach to dealing with the issue. Large-scale builder CentreCourt Developments currently has more than 40 claims in Toronto civil courts demanding that preconstruction buyers who defaulted at two of its buildings repay any losses compared to the agreed price and the eventual resale price.

As an example of its standard legal claim, on Aug. 30, a CentreCourt holding company (Church Residences GP Inc.) filed for at least $534,767 in damages from a buyer who in 2020 agreed to purchase a unit on the 32nd floor of the condo tower at 199 Church St. Centrecourt’s filing states that when the unit was ready for occupancy in June, 2024 – with a new adjusted price that was about $70,000 higher – the buyer who had already paid a $136,998 deposit asked for a delay of one month before eventually defaulting.

According to listings on Condos.ca, a similar-sized unit one floor below is currently for sale at $1,183 per square foot, but over the summer another similar-sized unit priced at $1,358 per square foot on the 10th floor sat unsold for 142 days before the listing was terminated in late September.

Legal claims against buyers are still a relative rarity, but Mr. Morris warned that a lack of court action doesn’t mean builders are sleeping. They can sue now, before they’ve “crystalized” their loss through a resale of a defaulted unit, or they can sue up to two years after they take the loss. Many, he warns, are taking the patient approach.

In hotter market conditions developers were able to sell these units through real estate agents or even to established clients. But with Toronto’s condo resale market sitting at nearly seven months of inventory builders can expect these units to sit empty for months, creating a costly drag on balance sheets.

Mr. Wilson’s solution is to launch a new auction site – www.inventorycondos.com – to assist buyers and builders find the actual market price of unsold units, a process he acknowledges may result in some losses for builders.

“They have their bottom line, they have to achieve a certain price,” he said, noting that some recently completed units are still being marketed at prices per square foot far above anything moving in the resale market. “Anybody who’s got a calculator will not be able to make sense of the prices that are being sought.”

A recently completed site he’s already signed up to auction unsold units is 8 Haus at 2433 Dufferin St., Toronto by Royalpark Homes.

“We need to find each other somewhere in the middle, and an auction is the mechanism to do that. We have to move this unsold inventory in order to get the market balanced,” he said.

.png)